Add lines 2 3 and 4 4. Tutsstar thousands of printable activities include geometry questions which will need to get answered.

Hairstyle Artist Indonesia 1040a Tax Form

3 Enter taxable income excluding SS benefits IRS Form 1040 lines 7 8a 8b 9-14 15b 16b 17-19 and 21 and Form 1040a.

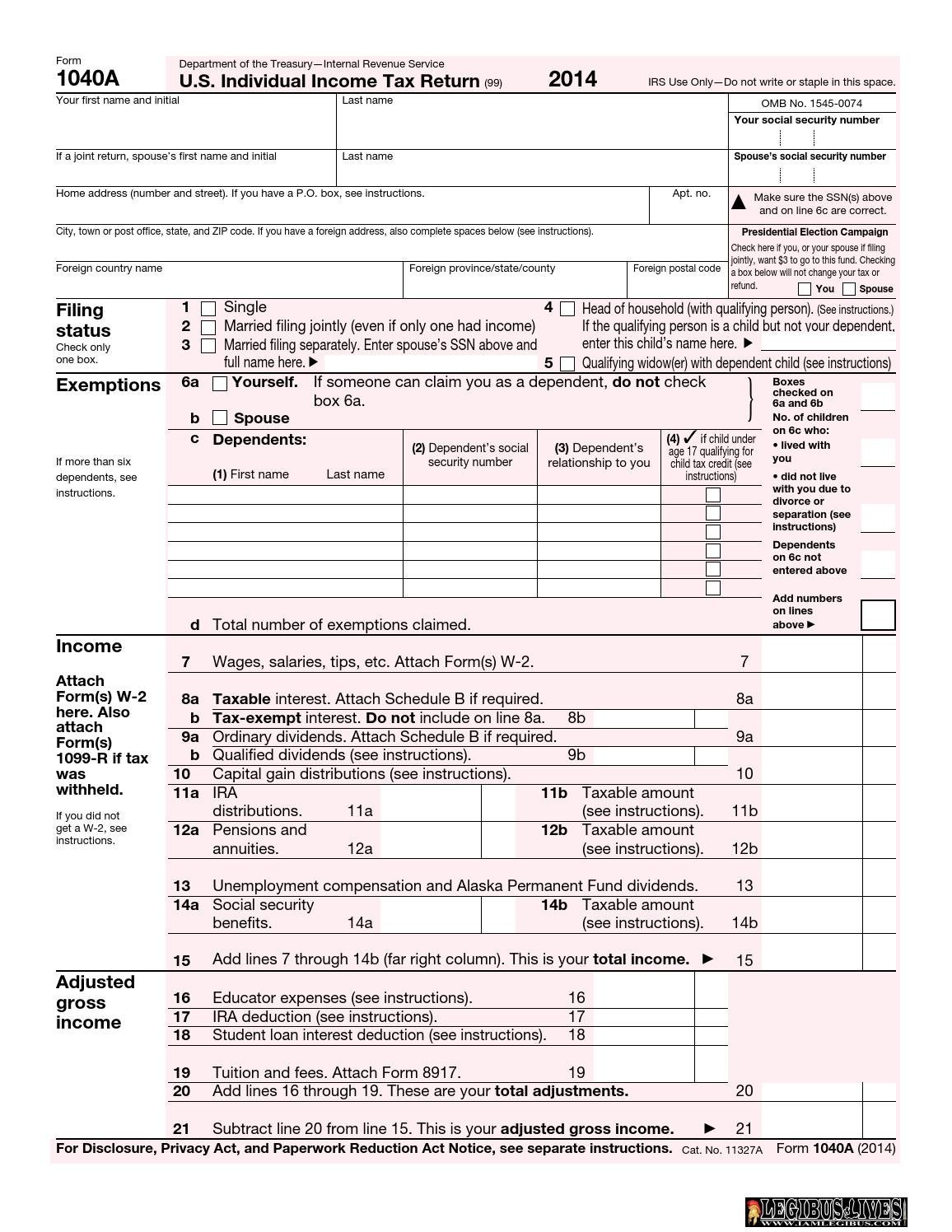

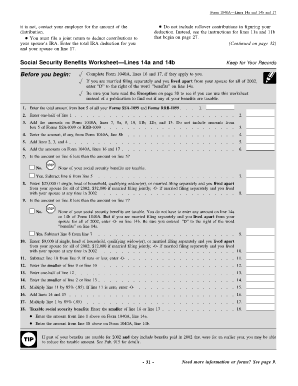

1040a instructions social security benefits worksheet. The worksheet provided can be used to determine the exact amount. 2013 Form 1040ALines 14a and 14b Social Security Benefits WorksheetLines 14a and 14b Keep for Your Records Complete Form 1040A lines 16 and 17 if they apply to you. Complete forms electronically using PDF or Word format.

Download files on your personal computer or mobile device. Social Security Benefits WorksheetLines 5a and 5b. The type and rule above prints on all proofs including departmental reproduction proofs.

For details on these and other changes see What s New in these instructions. Enter the total amount from box 5 of all your Forms SSA-1099 and RRB-1099 Add the amounts on Form 1040 lines 7 8a 9 through 14 15b 16b 17 through 19 and 21. The file is in Adobe portable document format PDF which requires the use of Adobe Acrobat Reader.

Social security worksheet for form 1040. Multiplies line a by line b. Social security benefit calculation spreadsheet.

Social Security Benefits WorksheetLines 20a and 20b - Form 1040 Instructions - HTML. Some of the worksheets for this concept are Social security benefits work lines 14a and 14b keep Social security benefits work forms 1040 1040a Benefits retirement reminders railroad equivalent 1 Social security benefits work work 1 figuring 2016 modification work Marketplace coverage affordability work Social security benefits work lines 20a and 20b Box. The taxable portion can range from 50 to 85 percent of your benefits.

INSTRUCTIONS Recovery rebate credit. 1 If the taxpayer made a 2019 traditional IRA contribution and was covered or spouse was covered by a qualified retirement plan see IRA Deduction and Taxable Social Security on Page 14-6. Ines 14a and 14b Social Security Benefits Worksheet Lines 14a and 14b Before you begin.

These areFor those filing as individuals with a combined income between 25000 and 34000 they are required to pay income taxes on up to 50 percent of their Social Security benefitsFor those filing as individuals with a combined income exceeding 34000 they are required to pay income taxes on up to 85 percent of their Social Security benefitsFor married couples filing jointly with a combined income. You have successfully completed this document. Social Security worksheet for Form 1040A.

Keep for Your Records Complete Form 1040A lines 16 and 17 if they apply to you. Do not use this worksheet if you repaid benefits in 2016 and your total repayments box 4 of Forms SSA-1099 and RRB-1099 were more than your gross benefits for 2016 box 3 of Forms SSA-1099 and RRB-1099. Income tax purposes as if they were paid under the social security legislation of the United States.

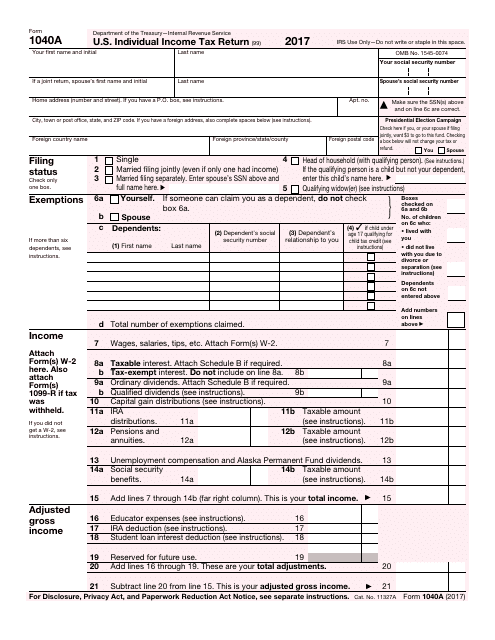

Residents are treated for US. Enter the amounts from form 1040a lines 16 and 17 is the amount on line 7 less than the amount on line 6. Social Security Benefits Worksheet 1040i 2017 Instruction 1040.

These social security benefits worksheet 1040a. You will recieve an email notification when. Worksheet for Estimating the Taxable Portion of Your Social Security Benefit 1 Enter total annual Social Security SS benefit amount box 5 of any SSA-1099 and RRB-1099.

None of your social security benefits are taxable. This credit is reduced by any economic impact payments you received. Figure any write-in adjustments to be entered on the dotted line next to Schedule 1 line 36 see the instructions for Schedule 1 line 36.

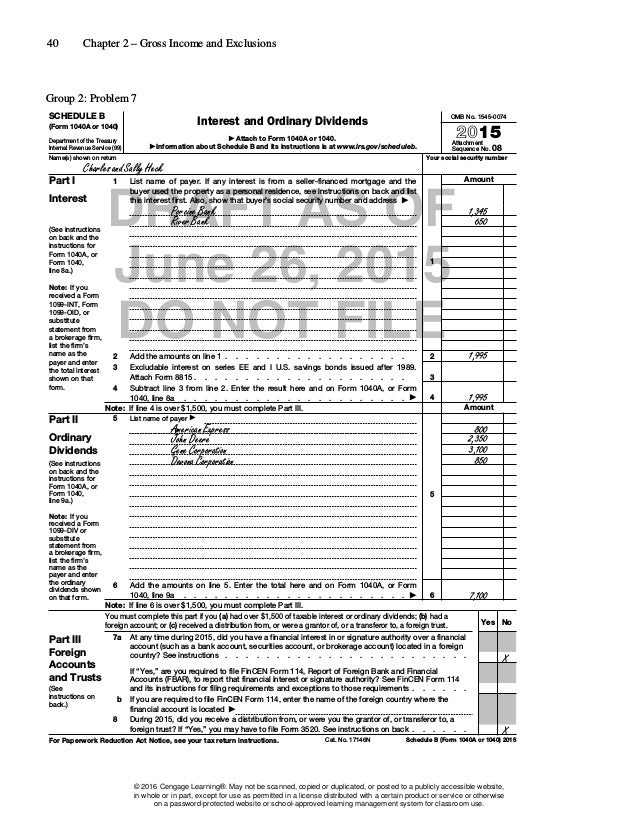

Social security benefits total 50061 and the taxable portion is 19372 39 method 1 42552. Social Security Benefits WorksheetLines 20a and 20b Keep for Your Records 1. When figuring the taxable portion of Social Security benefits two options are available for lump-sum benefit.

If you are married filing separately and you lived apart from your spouse for all of 2018 enter D to. This document is locked as it has been sent for signing. Social security benefits worksheetlines 14a and 14b keep for your records complete form 1040a lines 16 and 17 if they apply to you.

Social security benefits worksheet 1040a 2021. If you receive social security benefits from Canada or Germany include them on line 1 of Worksheet 1. Social Security Benefits Worksheet 2019 Caution.

Keep for Your Records. None of your benefits are taxable for 2016. Approve forms with a lawful digital signature and share them by way of email fax or print them out.

Social security benefits worksheet 2019 caution. 1040 2018 social security benefits showing top 8 worksheets in the category 1040 2018 social security benefits. Other parties need to complete fields in the document.

You can claim a deduction for charitable contributions if you dont itemize your deductions on Schedule A Form 1040. For more information see Repayments More Than Gross Benefits. Do not include amounts from box 5 of Forms SSA-1099 or RRB-1099 3.

2 Enter one-half of SS benefits from line 1. Benefits and other income the Social Security Benefits Worksheet found in the Form 1040 Instructions is completed by the software to calculate the taxable portion. You need a minimum of ten years to qualify for benefits.

If you are married filing separately and you lived apart from your spouse for all of 2005 enter. Under income tax treaties with Canada and Germany social security benefits paid by those countries to US. Do not use this worksheet if any of the following apply.

If you are married filing separately and you lived apart from your spouse for all of 2013 enter D to the right of the word benefits on line 14a. Forms Instructions Internal Revenue Service May 1 2019 - Access printable electronic versions IRS forms including Form 1040 and Form 941 along with instructions and related publications. Form 1040 line 20a or Form 1040A line 14a.

Make them reusable by creating templates include and fill out fillable fields. Social Security worksheet for Form 1040.

U S Individual Income Tax Return Forms Instructions Tax Table F1040 I1040 I1040tt By Legibus Inc Issuu

Social Security Worksheet For 1040a Nidecmege

U S Individual Income Tax Return Forms Instructions Tax Table F1040a I1040a I1040tt By Legibus Inc Issuu

Social Security Worksheet For 1040a Promotiontablecovers

Social Security Worksheet For 1040a Promotiontablecovers

Irs Instruction 1040 Line 20a 20b 2014 2021 Fill Out Tax Template Online Us Legal Forms

Income Tax On Social Security Benefits Back Alley Taxes

Social Security Benefits Worksheet 2019 Fill Online Printable Fillable Blank Pdffiller

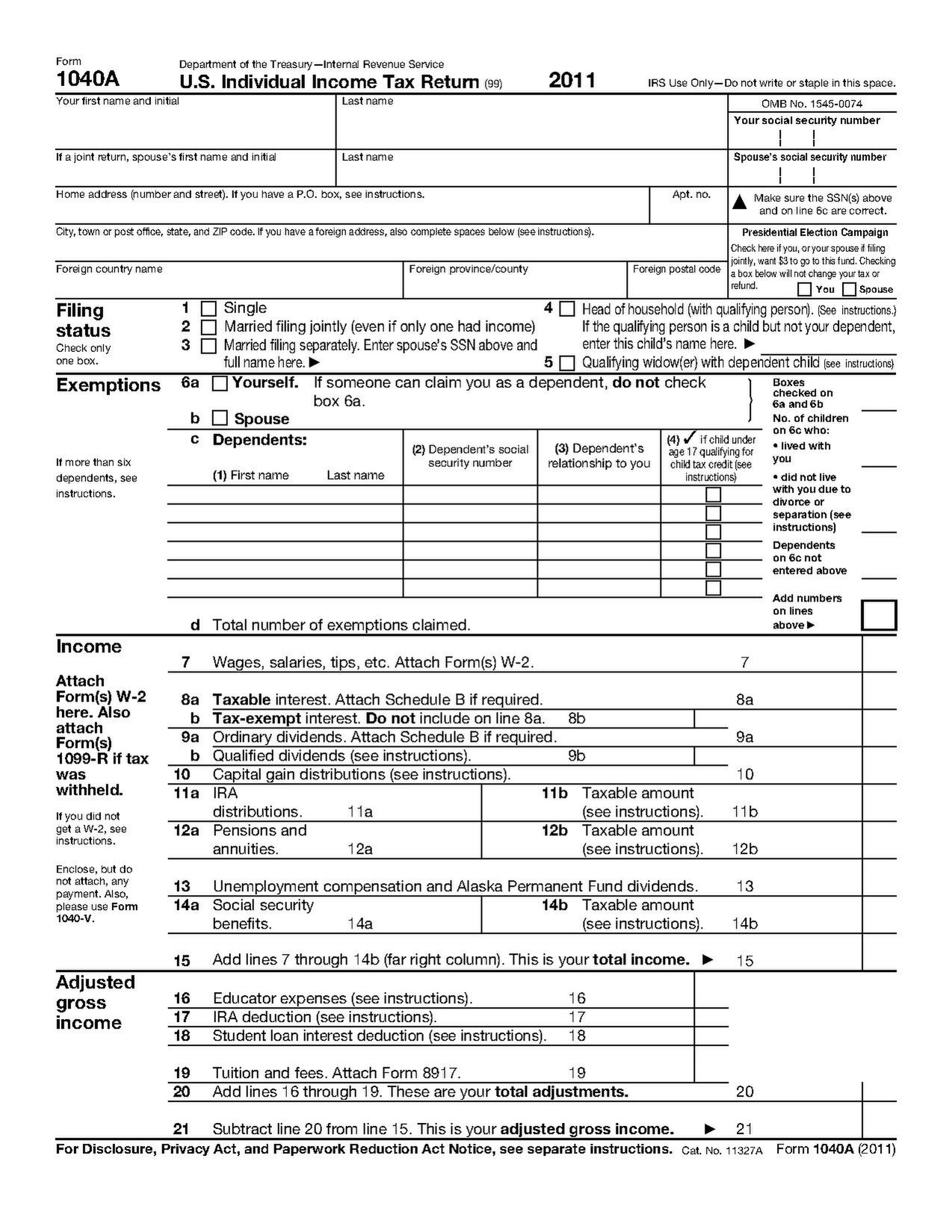

1040a Worksheet Fill Online Printable Fillable Blank Pdffiller

Income Tax Fundamentals 2016 34th Edition Whittenburg Solutions Manual

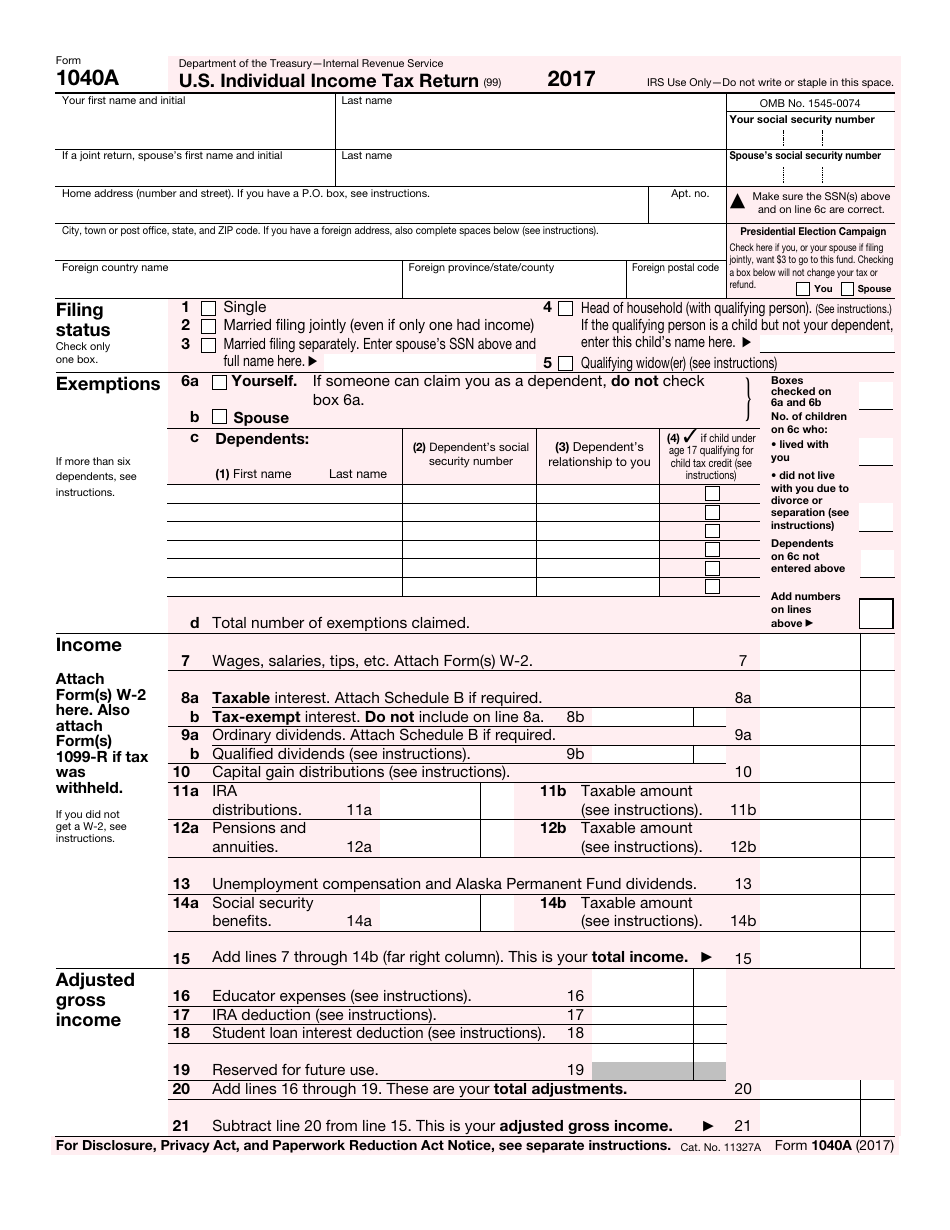

Irs Form 1040a Download Fillable Pdf Or Fill Online U S Individual Income Tax Return 2017 Templateroller

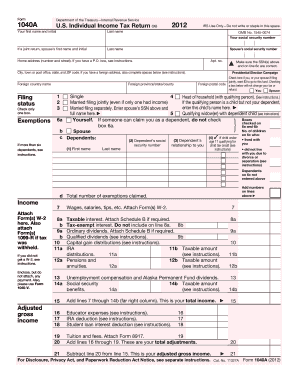

2012 Form Irs 1040 A Fill Online Printable Fillable Blank Pdffiller

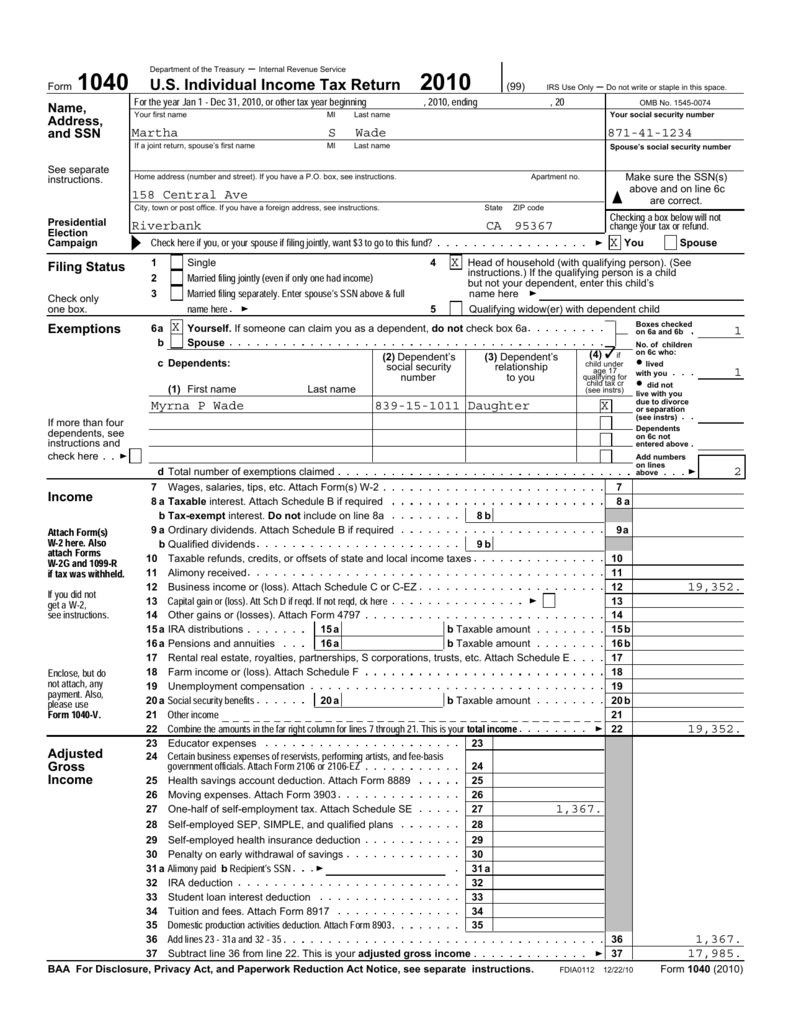

Form 1040 U S Individual Income Tax Return 2010

Irs Form 1040a Download Fillable Pdf Or Fill Online U S Individual Income Tax Return 2017 Templateroller

No comments:

Post a Comment